“The Basics of Personal Financial Management” is an important principle that everyone needs to know to manage their finances effectively.

Why do you need to know the 5 principles of personal financial management?

Knowing and applying the 5 principles of personal financial management will help you manage your assets more intelligently and effectively. This will not only help you maintain a stable financial life but also help you achieve your long-term financial goals.

1. Optimize income and expenses

– Identify sources of income and classify them into fixed income and incremental income.

– Determine a spending plan that is appropriate to your income and does not exceed your income.

2. Make a plan for dividing assets

– Divide money into different amounts and do not use one amount of money to overlap with another.

– Apply the 50/20/30 rule or the 6 jar rule to divide assets reasonably.

Applying these personal finance management principles will help you create a sound financial plan, help you maintain a stable financial life and achieve your financial goals.

Definition of personal financial management

Personal financial management is the process of managing and adjusting the use of money and personal assets in the most intelligent and effective way. This is the process of not only ensuring that spending does not exceed income but also helping to optimize the value of personal assets. Personal financial management also includes identifying sources of income, classifying and planning spending, checking and adjusting financial plans over time.

Key elements of personal financial management:

- Identify recurring income sources and classify them into fixed income and incremental income.

- Plan to divide your assets reasonably according to the 50/20/30 rule or the 6 jar rule.

- List your income and expenses in detail to determine how much money you need and cut down on unnecessary spending.

- Stick to your plan and keep careful records of all financial activities.

- Regularly review and adjust your spending plan to suit your actual needs.

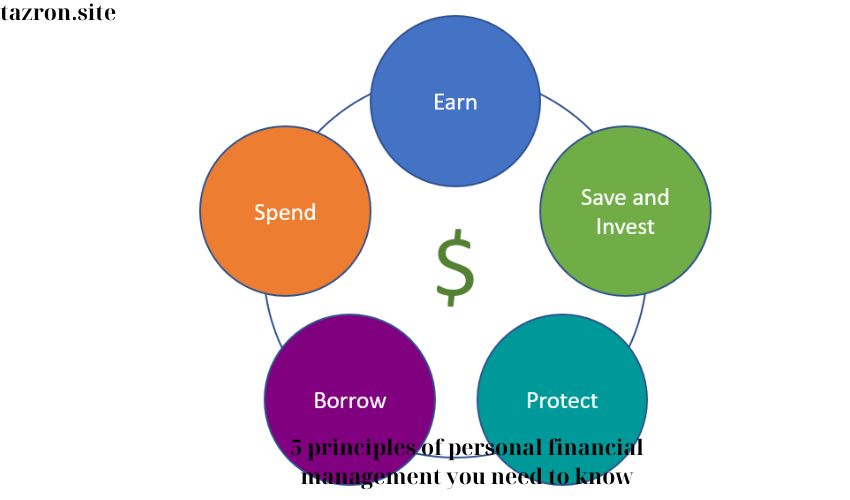

What are the 5 principles of personal financial management?

1. Identify sources of income

To manage your personal finances effectively, you first need to identify your recurring sources of income and categorize them into fixed income and incremental income. The principle of personal financial management is to ensure that your expenses do not exceed your income.

2. Have a reasonable asset division plan

Effective financial management requires planning how you will spend your money in the coming month. You need to divide your money into different categories and not use one type of money for another. You can apply the 50/20/30 rule or the 6 jar rule to divide your assets.

3. List in detail the income and expenses

This personal finance rule helps you clearly identify the spending activities that you will do during the month. Estimating the numbers helps you know roughly how much money you need to use and cut down on unnecessary expenses if your spending exceeds your income.

The Importance of Applying the 5 Principles of Personal Financial Management

Applying the 5 principles of personal financial management is extremely important to ensure the stability and growth of personal assets. This helps you control spending, increase income and ensure a healthy financial life.

1. Identify recurring income sources

- Fixed income helps you have a stable source of income every month, from which you can plan appropriate spending.

- Increased income can help you increase your income and accumulate assets.

Clearly identifying your regular income sources will help you have an overview of your personal finances and plan your spending appropriately.

2. Have a reasonable asset division plan

- Dividing money according to the 50/20/30 rule or the 6 jar rule helps you use money wisely and ensure spending goals are met.

- Multi-Fund on TNEX digital banking application helps you easily divide your income and track the increase/decrease of each amount.

A planned asset allocation helps you control your spending and save money for long-term financial goals.

Benefits of knowing and applying 5 principles of personal financial management

1. Save and increase income

By applying the principles of personal financial management, you will easily identify unnecessary expenses and thereby be able to save a significant amount of money. At the same time, focusing on increasing your income will also help you have more financial resources to invest and develop.

2. Avoid financial risks

By managing your personal finances effectively, you can anticipate and prepare for potential financial risks. Building a reserve fund and investing in safe investments will help you protect your assets and deal with emergencies.

3. Create financial reserves for the future

By applying the principles of personal finance management, you will be able to accumulate a reserve of money for the future, thereby creating financial stability and peace of mind. This also helps you to deal with the financial challenges that life presents with confidence and decisiveness.

4. Increase financial literacy

Managing your personal finances not only helps you create financial stability, but also helps you better understand how money works and investment opportunities. Increasing your financial knowledge will help you make smarter and more effective decisions in managing your assets and investments.

5. Reduce stress and financial worries

When you know your personal finances and have an effective financial plan in place, you will reduce your financial stress and anxiety. Having a clear financial plan will help you feel more secure and confident in dealing with difficult financial situations.

Knowing and applying the 5 principles of personal financial management will bring many financial and mental benefits, helping you have a more stable and happier life.

The first step in personal financial management

When starting the process of personal financial management, the first step you need to take is to determine your source of income. This helps you know for sure how much money you can use each month, from which you can plan your spending accordingly. You need to categorize your source of income into fixed income and incremental income to have an overview of your personal financial situation.

Fixed Income:

- The amount of money you will definitely get every month.

Increased income:

- Non-fixed amounts such as bonuses, allowances, commissions, etc.

Understanding your income sources is an important step to ensure that your expenses do not exceed your income, thereby helping you manage your personal finances more effectively.

A step-by-step guide to applying the 5 principles of personal financial management

1. Identify sources of income

To start applying the principles of personal financial management, you need to clearly identify your income sources, including fixed income and incremental income. Then, you can classify and determine the amount of money allowed to be used in the month to plan appropriate spending.

2. Plan for asset division

After determining your income source, you need to plan to divide your money into different amounts for specific purposes. You can apply the 50/20/30 rule or the 6 jar rule to divide your assets reasonably. In addition, the Multi-Fund feature on the TNEX banking application also helps you divide your income flexibly and easily track it.

3. List in detail the income and expenses

Listing your income and expenses in detail will help you determine how much money you need and consider unnecessary expenses. If necessary, you can apply the 24-hour rule to delay payment for unnecessary purchases.

How to implement 5 principles of personal financial management in daily life

1. Determine your daily income and expenses

To implement the principles of personal financial management, you need to clearly identify your daily income and expenses. Make a list of fixed and increasing income, and record daily expenses to clearly understand your financial situation.

2. Plan for reasonable division of assets

After determining your income sources, you need to plan a reasonable division of assets for different purposes. This helps you manage your expenses effectively and ensure that they do not exceed your income.

3. List in detail the income and expenses

Listing your daily income and expenses in detail helps you know how much money you need to spend and consider spending wisely.

4. Stick to the plan

To manage personal finances effectively, you need to persistently implement your plan and adhere to financial management principles.

5. Record all activities carefully

Keeping a careful record of all your daily income and expenses helps you keep track of your finances and adjust your plans when necessary.

Practice and adjust the 5 principles of personal financial management

1. Identify specific financial goals

First, you need to clearly define the specific financial goals you want to achieve. This will help you have a clear direction and focus on managing your finances to achieve that goal. You can make a list of short-term, medium-term and long-term goals, and then prioritize them in order of importance.

2. Create a savings and investment plan

Once you have determined your financial goals, you need to create a savings and investment plan to achieve them. Determine the savings and investment rate that is appropriate for your income, and create a specific plan for how you will save and invest your money.

3. Control spending wisely

Keeping track of your spending is an important part of managing your personal finances. Review your unnecessary expenses and try to cut them down. At the same time, focus on spending on goals that are important and necessary to you.

4. Find additional sources of income

In addition to saving and investing, you can also look for additional sources of income from different ways such as working part-time, doing online business, or investing in small projects. This helps increase your income and achieve your financial goals faster.

5. Adjust your plan over time

Finally, remember that your financial management plan needs to be adjusted over time. Regularly reassess your financial situation and adjust your plan to ensure that you are on track to achieve your financial goals.

Conclusion on 5 principles of personal financial management

After learning about 10 important personal financial management principles from TNEX, we can draw out the 5 most important principles to apply in daily life.

1. Identify income and expenses

– Classify income sources into fixed income and incremental income.

– Determine the amount of money allowed to be used in the month and plan appropriate spending.

2. Plan for asset division

– Divide money into different amounts, do not use this amount of money to overlap with another amount of money.

– Use the Multi-Fund feature to divide income into many types of funds, easy to use and track the increase/decrease.

3. List in detail the income and expenses

– Estimate the numbers to know how much money you need.

– Consider the necessity of the need and apply the 24-hour rule before shopping.

The above principles will help you manage your personal finances intelligently and effectively, and create a healthy and stable financial life.

Basic principles of personal finance management need to be followed to ensure stability and growth of personal finance. Saving, investing wisely and managing debt properly will bring long-term benefits to everyone.